Table of Content

Rates assume a loan amount of $25,000 and a loan-to-value ratio of 80% for a 15-year home equity loan. Choosing between aHELOC and a home equity loancomes down to your financial situation, needs and priorities. Home improvements - Using your home equity to pay forhome improvement projects that increase the value of your home can be a smart move. Connexus home equity loans are not available in Maryland, Texas, Hawaii and Alaska. Customer support by phone is available Monday through Friday from 8 a.m.

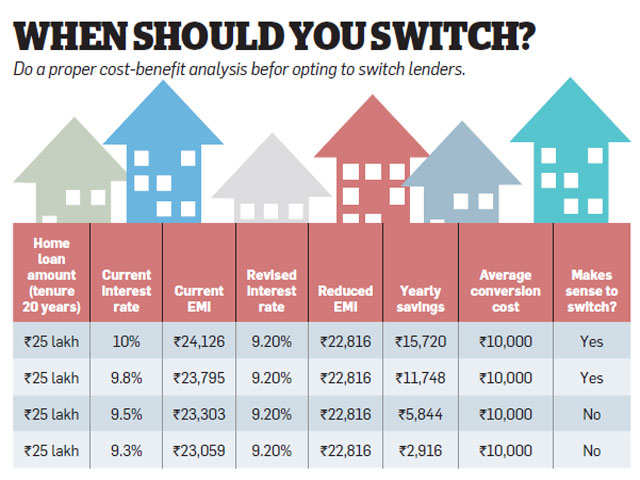

Ask around for recommendations or use an online tool to find a lender who can provide you with a loan that is best for your situation. Online account access lets you save time, view your loan balance, monitor transaction history and make payments with free Bill Pay. HELOCs offer attractive borrowing rates for large sums of money—up to 65% of your home’s value. If you use a credit union or lock part of the HELOC into a regular mortgage, you can borrow up to 80% of the home’s value. There’s no downside to switching financial institutions if you find one offering mortgage and/or HELOC terms that are superior to your existing lender. However, it’s important to do the math first to ensure the move makes financial sense once you factor in fees and mortgage breakage penalties.

What are today's mortgage rates?

How much cash you can pull out of your home with a cash-out refinance depends on how much home equity you have. Lenders will typically require you to keep at least 20% equity in your home. For example, if your house is worth $250,000 and you owe $150,000 on your mortgage, you have $100,000 worth of equity. You can refinance to a new mortgage worth up to $200,000 while still keeping 20% ($50,000) equity in your home. After you use the funds to pay off your existing mortgage, you’ll be left with $50,000 in cash .

There are no closing costs on home equity loans or HELOCs from U.S. Bank, but you’ll be charged an early closure fee of 1% of the line amount ($500 max) if you close your HELOC within 30 months of opening. In addition, HELOC borrowers may be charged an annual fee of up to $90, which can be waived with a U.S. U.S. Bank offers a rate discount of 0.5% for home equity loan borrowers who set up automatic payments from a U.S. Additionally, those securing a home equity line of credit through Bank of America can receive monthly rate discounts by setting up automatic monthly payments or being a preferred banking client.

Third Federal Savings and Loan: Best home equity line of credit with a long repayment term

The amount you can borrow depends on how much equity you have, your financial situation and other factors. Bankrate analyzes loans to compare interest rates, fees, accessibility, online tools, repayment terms and funding speed to help readers feel confident in their financial decisions. Our meticulous research done by loan experts identifies both advantages and disadvantages to the best lenders. Regardless of what you plan to use the money for, determining the best home equity loan for your situation is key. Ensuring you’re able to borrow enough money and meet all approval qualifications — and that the payback schedule works for you — are all essential to a great borrowing experience. Rates will vary depending on where you live, but BBVA Compass will pay your loan in a lump sum and may cover the closing costs for your loan if you meet the company’s criteria.

It takes time to assess your options and find the right lender for you, which may include getting a better deal. This is still lower than what many people can access through most unsecured loans. Some people with an excellent credit score might be able to get competitive rates to a HELOC or even better. The average interest rate for a home equity loan at the time of writing and subject to change is between 5% and 6%. If the loan term is shorter, the interest falls at the lower end between these figures – and vice versa.

Five Alternative options to a home equity loan

The average rate for a variable-rate home equity line of credit is 5.61%. Interest paid on a HELOC istax deductibleas long as it’s used to “buy, build or substantially improve the taxpayer’s home that secures the loan,”according to the IRS. So if you had a $600,000 mortgage and a $300,000 HELOC for home improvements on a house worth $1.2 million, you could only deduct the interest on the first $750,000 of the $900,000 you borrowed.

As with any loan, if you miss or make late payments, your credit score will drop. The amount by which it will drop depends on such factors as whether or not you've made late payments before. However, HELOCs are secured loans that are backed by your property, so they tend to affect your credit score less because they're treated more like a car loan or mortgage by credit-scoring algorithms. A home equity loan, which lets you borrow money against the equity you've built in your home, provides you with a lump sum of cash at a fixed interest rate. Home equity is the difference between what you owe on your mortgage and the current appraised value of your home. You build home equity by making consistent monthly mortgage payments over the years.

Let each lender know that you're shopping around and allow them to compete for the best terms and interest rates. A home equity line of credit, or HELOC, could help you achieve your life priorities. At Bank of America®, we want to help you understand how you might put a HELOC to work for you.

In the beginning, however, most HELOCs come with a lower introductory rate period, but the length of those initial rates will differ by lender, and you want to find the longest one possible. The longer you have a lower interest rate, the more money you'll save over time. Once you complete a cash-out refinance, you’re left with a new mortgage loan with new rates and terms. You’ll pay this loan back in monthly installments, with interest, just like your previous mortgage.

Instead, you can use a home equity loan to only take out the money you need, rather than replacing your entire mortgage with a higher interest rate loan. The Fed's upcoming December meeting will also signal what's likely to happen in 2023. Interest rate futures already suggest that rates will settle between 4% and 5%. A home equity loan makes more sense for a large, set expense because it’s paid out in a lump sum. If you have smaller expenses that will be spread out over several years, such as ongoing home renovation projects or college tuition payments, a HELOC might be a better option.

Continue to use your home equity line of credit as needed for the duration of your borrowing period, usually 10 years. Remortgaging is when you switch from your current mortgage to a new mortgage for a better deal. However, it is possible to remortgage for more money and tap into your equity.

That means failure to make timely repayments could put you in jeopardy of losing the property. Many borrowers use them for home upgrades or repairs, but education costs or other large purchases are also allowed. Don’t forget that the variable interest rate on a HELOC may mean that other forms of financing make more sense. A cash-out refinance is when you pay off your existing home loan by getting a new one that’s larger than what you currently owe.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. The bank will also generally apply a theoretical payment based on a 25- or 30-year amortization, and make sure you can afford it—again, assuming you maxed out the HELOC.

How to compare mortgage rates?

Adjust the graph below to see historical mortgage rates tailored to your loan program, credit score, down payment and location. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Review them below, and compare rates, loan amounts, terms and other factors to determine which option works best for you.

Right now, however, Old National’s home equity loans are only available in Illinois, Indiana, Iowa, Kentucky, Michigan, Minnesota and Wisconsin. Home equity loans and cash-out mortgage refinancesare both potential ways to get money for home renovations or unexpected expenses. Generally speaking, if you're planning on doing multiple home improvement projectsover an extended period of time, a HELOC may be the better option for you. If you're thinking aboutconsolidating high-interest credit card debtor doing a larger home improvement project that would require all of the funds upfront, a home equity loan may be the best option.

No comments:

Post a Comment